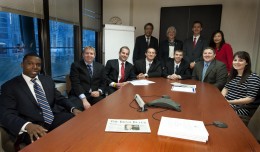

On the day of the bond sale at Fifth Third, Vice President of Business and Fiscal Affairs and University Treasurer Mark M. Polatajko and his staff were joined by five Wright State undergraduate finance students, two MBA students, Raj Soin College of Business Dean Joanne Li, Ph.D.; Marlena Akhbari, Ph.D., chair of finance and financial services; and finance professor Fall Ainina, Ph.D.

Two hours, maybe less? That’s how long it took Wright State University, with its A1, stable outlook Moody’s rating, to raise $25 million with a general receipts bond offering.

Wright State capitalized on support and collaboration to drive a success story that touched all levels of the university. The financial results speak for themselves: 2.9 percent all-in interest cost and $1.3 million in net present value savings refunding. The real story however, goes beyond the financial success.

The bond sale was underwritten by Fifth Third Securities, a division of Fifth Third Bank in Cincinnati on Oct. 18. Huntington Investment Company and PNC Capital Markets LLC were the underwriting syndicate members. The offering was oversubscribed and sold out rapidly due to the excellent rating Wright State received and the effective timing of the offer. “We placed 100 percent of that bond offering,” said Mark M. Polatajko, vice president of business and fiscal affairs and university treasurer.

About 5 percent of the issue, roughly $1.2 million, was scooped up by local investment managers who recognize the university’s strong financial position. Wright State enjoys a unique relationship with many of these firms, and some have a history of snapping up new talent from Wright State’s Raj Soin College of Business.

“We were able to meet an aggressive timeline by using all of our resources and working collaboratively with the board, our faculty and involving our students too,” said Polatajko. “It’s truly a great success.”

The money will be used almost exclusively on student-focused structures including the new Classroom Building, the Woods Student Commons building and for repurposing the existing grounds storage facility.

Students, faculty and Dean Joanne Li, Ph.D., of the Raj Soin College of Business played integral roles in the bond sale and saw firsthand how it was executed. Li, Marlena Akhbari, Ph.D., chair of finance and financial services, and finance professor Fall Ainina, Ph.D., joined the university financial team that evaluated potential bond underwriters earlier this fall.

On the day of the sale, five undergraduate finance students and two MBA students along with Li, Akhbari, and Ainina joined Polatajko and his staff at Fifth Third.

“Experiential learning is what the Raj Soin College of Business strives for. The collaboration between the administration and the faculty to make this bond offering an invaluable learning opportunity for our students is one of the unique attributes that makes Wright State University so special in higher education,” said Li.

Drew Marcy, a finance and accountancy major, and Isaiah Hill, an economics major, both said experiencing a real-life, complex finance transaction is an opportunity that few students receive.

“One of the things I value most about my education is the personal mentoring from our great faculty, but I also find invaluable the many opportunities our professors give us to meet leaders in our future careers,” said Marcy.

Fifth Third Bank executives shared their expertise with students as the bonds were priced and sold throughout the morning.

“The leaders at Fifth Third were truly generous with their time and personal attention,” said Akhbari. “Our students’ immersion in an actual bond sale was timed perfectly with the numerous innovations we have developed for our finance curriculum this fall, including a new fixed income securities class and a new MBA concentration in investments.”

Later in the day, students and faculty also met with the Fifth Third retail, wholesale and item processing management teams and Scott Mumpower, a College of Business alumnus.

“Traditionally students learn finance in the classroom. For these students to be immersed into an actual bond pricing on the trading floor, participate in pre-market open pricing strategy and observe the execution of the bond sale is simply amazing,” said Polatajko.

Bottom Line, Wright State partnership aims to increase access to college

Bottom Line, Wright State partnership aims to increase access to college  Wright State’s nursing program celebrates 50th anniversary

Wright State’s nursing program celebrates 50th anniversary  Wright State celebrates Student Success Champions

Wright State celebrates Student Success Champions  Wright State gold team captures 2024 Horizon League team title, Flynn individual champion

Wright State gold team captures 2024 Horizon League team title, Flynn individual champion  118 medical students to graduate from Wright State’s Boonshoft School of Medicine April 28

118 medical students to graduate from Wright State’s Boonshoft School of Medicine April 28