As the cost of medical care and prescription drugs continues to increase, Wright State University and its employees are paying more to keep up with the increases. The university has taken steps to mitigate the cost for employees as well as for the university.

In an effort to help employees understand Wright State’s medical and prescription coverage plan and the tools employees can use to limit cost, Human Resources professionals have detailed the changes with presentations at Staff Council and with department chairs and deans. A presentation to the Faculty Senate is expected during the 2018-2019 academic year.

As a result, the university has made numerous changes in its health care coverage for many employees.

As a result, the university has made numerous changes in its health care coverage for many employees.

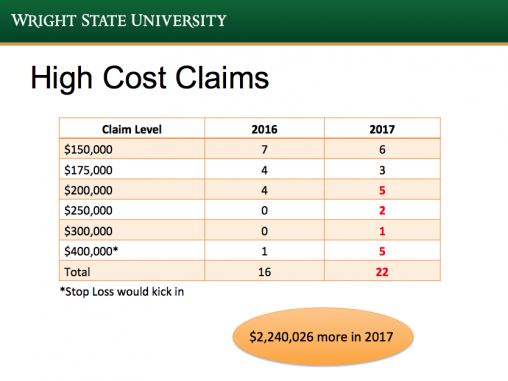

In 2017, the cost of Wright State’s health care plan was $31.7 million and driven by high-cost claims and specialty drugs expense. The fiscal 2019 budget earmarks an additional $5.5 million for medical claim expense overage experienced in 2018. And in 2019, medical costs are projected to increase by 8.6 percent and prescriptions by 12 percent.

The presentations have been an effort to educate the campus community about the changes and why they were made. Most importantly, the presentations have been made to give employees guidance on where to seek appropriate treatment and how to use consumer-shopping tools, so they know more about what they can do to help curb spending. Castlight is one such tool that helps employees find personalized, high-quality health care.

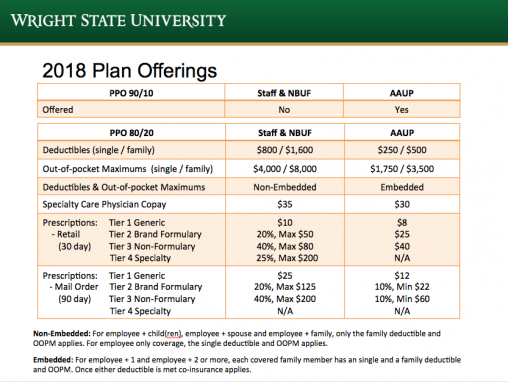

The university’s Preferred Provider Organization (PPO) plan offers medical coverage through a network of designated physicians and hospitals. Employees pay less if they use providers who belong to the plan’s network.

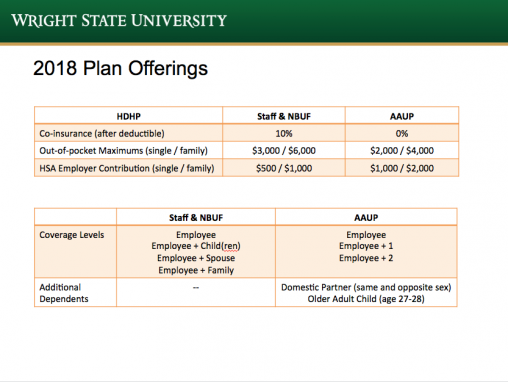

Several changes in coverage have also been made. Coverage for new staff and non-bargaining unit employees now goes into effect on the first day of the month after they are hired and not their first day on the job. And the policy of limiting claims to a specific amount, known as stop loss insurance, has been expanded from medical claims only to include pharmacy claims. This decision was largely in response to the exponential growth and costs of specialty drugs.

There are also several changes in the plan for staff and non-bargaining unit faculty.

The PPO 90/10 plan for these employees was eliminated, and the PPO 80/20 plan for them now requires increased deductibles and out-of-pocket maximums. Coverage for domestic partners will end on Dec. 31. The university’s contribution to the Health Savings Account has been reduced. And the Healthy Rewards program has been eliminated. Further, the university added a fourth drug tier for specialty drugs.

For bargaining unity faculty members – whose plan was set by their contract four years ago – the PPO 90/10 plan remains available. That plan provides for less to be paid in deductibles, out-of-pocket maximums and for prescriptions than other university plans. Domestic partners are also covered, as are older adult children age 27-28, which was reduced to age 26 over a year ago for staff and non-bargaining unit faculty.

View the presentation to learn more about the medical and prescription plan changes.

Bottom Line, Wright State partnership aims to increase access to college

Bottom Line, Wright State partnership aims to increase access to college  Wright State’s nursing program celebrates 50th anniversary

Wright State’s nursing program celebrates 50th anniversary  Wright State celebrates Student Success Champions

Wright State celebrates Student Success Champions  Wright State gold team captures 2024 Horizon League team title, Flynn individual champion

Wright State gold team captures 2024 Horizon League team title, Flynn individual champion  118 medical students to graduate from Wright State’s Boonshoft School of Medicine April 28

118 medical students to graduate from Wright State’s Boonshoft School of Medicine April 28